Australia

Cold hard cash or cold hard rock- discover what Cold Rock competition chose!

Cold hard cash or cold hard rock- discover what Cold Rock competition chose!

Further proof that diamonds are a girls best friend.

The low down on Din Tai Fung. What you need to know about the dumpling chain everyone’s talking about!

Are these the best dumplings in the world?

What you need to know about the new Mrs Fields

Cookie chain branching out into cafes. Mrs Fields has announced a major role out of its Mrs Fields Bakery Cafes. The cafes, which first opened in August 2012, were a response to customers telling the chain that “our stores were too sterile and cold. To them they certainly did not fit the comforting home style baked cookies associated with Mrs. Fields” according to Chief Cookie and CEO, Andrew Benefield. The new look cafes have been a success and the group is keen to role out the new concept across their other stores. As Benefield goes on to explain “like anything new we have learnt along the way and made plenty of changes, but with the four original trial stores all showing double digit sales growth in the first half of this financial year, we are now ready to fully roll out the new concept”. By the end of the year, Mrs Fields hopes to have 38 locations, over half of which conform to the new look. Andrew Benefield, CEO gives us the low down:

3 reasons why Lamb Weston is a cut above other potato brands

All about consistency, higher quality and diversity.

Was Nando’s Mango Gate a genius marketing move?

See whether the sensational stunt helped or hurt the PERi-PERi brand.

Ribs and Rumps heads south

First store in Victoria to open at Northlands Shopping Centre in Melbourne’s north.

An inside peek at Nando's Mangogate

What went on behind the scenes?

Muffin Break's "win a cup a day" promotion

10,000 entries have been received.

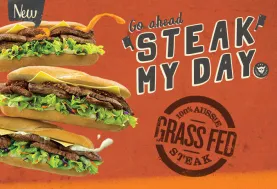

Oporto promotes steak in major campaign

Fresh meat now on the menu.

Pizza Hut launches Cheeseburger Crust Pizza

It will be launched today, with WA slated for March 18.

Franchise funding... Is help on the way?

Comments from Small Business Minister have roused market participants.

RFG results announcement- what you need to know

Bumper profits reported, with pizza chains performing particularly well.

THE HOT SEAT: New Croissant Express Chief on the future of the chain

What changes can we expect?

Nando's unmasked as Bowen Mangoburgler!

Hamburgler reported to be sleeping easier tonight..

Issue of the Month: Nando's innovative and audacious Mango stunt

More to it than just hiring a crane!

Find out what is setting the "new" Donut King apart...We talk exclusively with CEO Nicholas Brill following the recent store opening

Customisation is the key.

Markwell Foods introduces new food products across 4 key markets

See the breadth of their fresh offerings.