Can Australian gourmet burger chains sustain segment growth?

Burger Project, Ribs & Burgers and Red Rooster execs share the latest trends in the category.

What was once a segment fully dominated by traditional burger shops is now slowly being transformed by niche establishments.

Over the past five years, typical fast food operators have felt competitive pressures due to consumer-driven trends such as healthier eating and premiumisation. Whilst demand constrained revenue for typical burger shops, it also provided growth opportunities for small-to-medium-sized restaurants and independent players.

Looking back at how the Australian burger scene changed in the past five years, Rockpool Dining Group culinary director Neil Perry noticed a return to the classic style of burgers. This time, however, it now has a lean on quality and sustainability.

“There is much more opportunity to make better quality burgers with a focus on sustainable produce, such as pasture-raised beef, organic and free-range chicken and ethically raised pork. There is also a lot more competition, so chefs look to make their creations stand out by getting creative,” he told QSR Media.

Rockpool Dining Group-owned Burger Project currently has 13 burgers, including a vegetarian option. Each month, the fast casual burger chain designs a limited-edition burger in a bid to Australian produce whilst representing different cultures through various flavour combinations.

Ribs & Burgers, which recently launched their ‘Beyond’ meat-free burger range, said a burger today is not “just a patty between two buns.” Previously making headlines for their colourful burgers, the fast casual boutique restaurant stressed the need for brands to constantly innovate to meet evolving customer needs.

“We have seen an evident move from industry heavyweights to bespoke brands/stores. There is more art and finesse within the market. Five years ago, we did not have the delivery service providers, which has opened new opportunities for brands to be noticed on the various platforms,” Ribs & Burgers national marketing manager Adam Issa said, adding that delivery accounts for more than 15% of their sales.

This month, the brand confirmed it will launch across the country’s three biggest aggregators.

“Over the next few months, we will launch dark kitchens that would service areas that we yet to have a presence. This will play two parts; one being able to service our customers where they live and secondly to test whether the demand is big enough for us to open a fully operated store,” Issa added.

Fast food giants McDonald’s and Hungry Jack’s have been responding to the changing Aussie burger scene by offering their own takes on premium and vegan-friendly items. Seeing growth opportunity in the space, other brands recently tossed its hat in the burger ring.

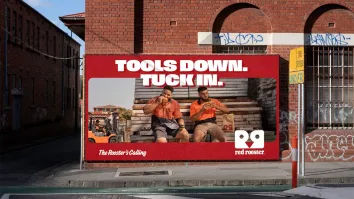

Red Rooster, primarily known for their roast chicken and rolls, recently launched their Hellfire burger range in a bid to reach a younger market.

“Burgers offer us the opportunity to extend into new occasions for consumers that are looking for quality and great tasting burgers. Spice was lacking on our menu and we know spice has been trending for some time and thus it was about time we had a spicy burger offering,” Red Rooster marketing director Ashley Hughes explained.

Premiumisation still biggest growth opportunity

Market research company IbisWorld expected industry revenue to grow at an annualised 4.7% over the five years through 2018-19, including a 2.6% revenue increase to AU$7.6 billion. But despite growth at the premium end of the market, the segment is forecasted to grow at a slower pace.

Over the five years through 2023-24, revenue is projected to grow at an annualised 2.2% to AU$8.5 billion, with premiumisation still playing a key role for the segment’s growth.

“Premiumisation will provide the biggest opportunity for revenue growth over the next five years. Consumers are increasingly aware of what constitutes quality food and are willing to pay for quality products. Consequently, an operator’s ability to embrace this trend has become one of the main keys to success,” IbisWorld senior industry analyst Bao Vuong explained.

Whilst some operators have been introducing healthier options, Vuong said competition from non-burger companies negatively affected the industry. This is offset, however, by strong consumer demand for quality burgers and American food, benefiting independent burger shops.

“Burgers have become the darling of the Australian food scene, with numerous independent burger shops becoming renowned in their area. Many of these shops offer simple burgers, American-influenced with few ingredients. Consumers have also demonstrated a penchant for big burgers with a range of non-traditional ingredients, including hash browns, jalapenos and dimsum.”

But can gourmet burger chains sustain the forecasted growth? Vuong says yes.

"Industry heavyweights have already been developing their own premium options and it really has not been of that much assistance to these gourmet burger chains. This is because consumers still see these heavyweights as more of a fast-food option, than where one can get gourmet burgers. So yes, it is feasible that these gourmet burger chains can sustain this growth especially as they continue to differentiate from the industry heavyweights and focus on its image, fresh produce and quality ingredients."

And despite the inclination towards healthier options, burgers are still considered by consumers as an indulgence.

"As many consumers incorporate ‘cheat meals’ into their otherwise healthy diet, a burger with sides is viewed as an indulgent treat. The cheat meal trend has reduced the negative impact healthier eating has had on the industry over the past five years," Vuong added.

Tasting good, looking good

To meet preferences, Vuong said operators across the industry are anticipated to continue expanding menu options and make them more appealing.

“Consumers are taking photographs of their meals to post on review websites and social media networks, so operators are increasingly required to provide products that taste and look good, in an appealing environment. This trend is projected to become more popular among burger shops over the next five years and is already being reflected in most new shop openings.”

Hughes shared the same observation, explaining that there has been a decisive shift for burgers to be “decadent, indulgent and memorable.”

“There’s a definite move now in Australian restaurants and QSRs towards ‘food porn’. One look at Instagram will reaffirm this. Customers’ tastes have become more discerning and they are not only on the hunt for food that tastes sensational, but also looks sensational,” he added.

But whether it is premium or traditional - executives cannot discard great flavour as a must-have ingredient for a good burger that will connect with customers.

“A good burger is many things to many people, but undeniably this includes balance, texture, flavour and eat-ability,” Hughes explained. “Well-balanced flavours, every ingredient has to be on it, or not on it for a reason, texture and mouthfeel need to be considered and it has to be easy to eat if you’re on the go.”

“Customers look for modest flavours which are well-executed. Our cheeseburger, for example, is one of our best sellers and comprises simply of a grass-fed beef patty, cheese, onion, pickles, tomato and lettuce, which we finish off with a secret, house-made sauce,” Perry said.

“The burger space is an extremely competitive one and it is no longer good enough to simply 'rearrange the furniture'. As such, we will be looking to push the boundaries by offering selective cuts of meat that very few of our competitors can match,” Ribs & Burgers food manager Etienne Lubbe said.

“Apart from physical burger products we are also looking at 'different ways' of eating the traditional burger. We plan to align these learnings with our brand DNA to truly disrupt the category and take our customers on a fresh and exciting flavour experience.”