QSRs remain resilient against consumers cutting back on spending

Aussies cutting back would just mean they would be pushed towards cheaper eating options.

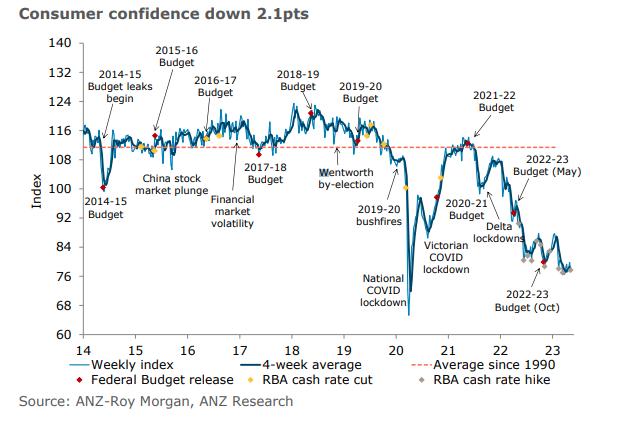

Consumer confidence fell by 2.1 points following the surprise announcement of The Reserve Bank of Australia that it would raise its cash rate by 25 basis points however analysts believe that most QSRs can weather the storm.

A survey by ANZ Bank and pollster Roy Morgan revealed that consumer confidence in the first week of May was at 77.7, and the 10th straight week that confidence was below 80 since the 1990-1991 recession.

The ones hit hardest were those still paying off their homes, with consumer confidence amongst those cohorts falling by 3.2 points. This leaves consumers no choice but to cut back.

Talking to QSR Media, Carlos Cacho, Chief Economist at Jarden, said that with the rate hikes up, most consumers are taking to reducing their household disposable income.

“This is likely to see households pulling back on discretionary spending, including eating out. That said, historically QSR spending has been more resilient than overall food spending during challenging economic periods as households look to down-trade from full-service restaurants to more affordable QSRs. From a business perspective interest rates will also increase the cost of debt for QSR operators.” Carlos said

Tim Foulds, Head of Insights at Euromonitor International agreed that rate hikes will put pressure on Australians' spending power, particularly for discretionary items such as eating and drinking out.

However, this would only push most Australians to save their money towards cheaper meal options.

Tim said that signs of recovery over the post-pandemic summer have been nipped in the bud. Aside from mortgage holders, rents will also increase as landlords pass higher mortgage costs.

“This affects younger consumers with low savings buffers disproportionately – exactly those consumers who would like to throw caution to the wind and go out and enjoy themselves. Euromonitor expects cheaper foodservice and takeaway options to hold up relatively well, given younger consumers have no desire to cook meals alone at home, and for standard alcoholic drinks to regain some momentum vis a vis premium, aspirational alternatives, although continued sobriety could put a dampener on the whole sector,” Tim said.

Carlos adds that this could be a potential opportunity for QSRs to highlight their value proposition and drive increased spending through affordable bundling.

Wage hike pressures

Carlos said rate hikes should actually dampen inflation pressure.

“While they are not likely to see outright price falls the reduction in aggregate demand should see price rises moderate – we’re already seeing this in some discretionary categories like household goods and clothing,” Carlos explained.

Carlos said that most likely, business owners would likely be pressured to increase wages which means most QSR operators will push prices to maintain their margins.

“Wages and labour availability have been a key issue for the overall economy and hospitality sector in particular. Whilst the return to migration, particularly students, is a clear positive for labour availability, wage pressure is likely to remain elevated. Importantly, the majority of wages in QSR are impacted by award/minimum wage decisions, with the next increase due in June (effective from July). Based on the inflationary outlook and the very tight labour market another large increase is likely which will see a material rise in QSR labour costs,” Carlos added.

On the positive side, Carlos said Australia is seeing inflation moderate, particularly in goods as supply chain pressures ease – that said they still remain elevated vs pre-covid, and continue high energy prices are likely to mean some processed products continue to see rises.