payo CEO: Eat Now, Pay Later could just be the new normal in dining

Consumers are excited to dine out again, but they're also looking for ways to simplify their experience.

With the increasing popularity of buy now, pay later (BNPL) options in retail, it was only a matter of time before the same concept made its way to the hospitality industry. Enter ENPL (eat now, pay later), which is quickly gaining traction as a popular payment option for quick-service restaurants (QSRs).

ENPL works similarly to other BNPL programs: customers pay 25% upfront with additional instalments paid fortnightly, with no interest or account fees charged. This allows diners to enjoy their meal now and pay for it later, without having to worry about budgeting for the full cost upfront.

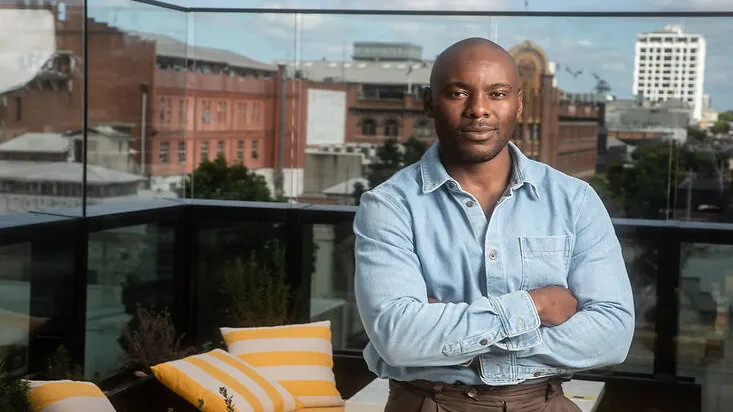

In Australia, payo is the first provider of the BNPL option that is exclusive to hospitality and CEO Taf Chiwanza believes that this payment option could soon become the new normal in dining. "We saw the success of BNPL in retail and wanted to provide the same currency for millions of Aussies in hospitality," he says.

Chiwanza believes that the benefits are two-fold: not only does it improve the dining experience for customers, but it also allows them to enjoy their meal more responsibly. "The flexibility that BNPL provides encourages people to budget and spend more responsibly," he explains. "It's a win-win for both diners and businesses."

So far, payo has seen promising results since launching in early 2021. Credit card applications are at an all-time low, and Aussies are embracing BNPL at an unprecedented rate. Many customers are now happy to pay for their meals via payo rather than using traditional payment methods such as credit cards or cash.

At this point, Chiwanza notes that their biggest challenge in making BNPL a fixture in Australia’s hospitality industry is education. "There's still a lot of education that needs to happen around BNPL," he says. "But we're confident that, as more people learn about the benefits of this payment option, it will become the new normal in dining."

Restaurant owners, in particular, could benefit from learning more about how it can help their businesses. With the right knowledge, they'll be better able to meet the needs of their customers and keep up with rising demand for this payment method. As payo CEO Chiwanza notes, "Educating ourselves on what our customers want is key."

And what do QSR customers look for, exactly? Chiwanza thinks that, for many diners, it’s all about convenience. Post-pandemic, consumers are excited to dine out again, but they're also looking for ways to simplify their experience, including payments.

For restaurant owners, then, the takeaway seems clear: offer BNPL options to your customers, and you'll be better able to meet their changing needs. "Customers want a quick and easy payment option that doesn't involve cash or cards," he says. "BNPL provides that, and we think it's here to stay."

Chiwanza is confident that it holds a lot of potential for both restaurant owners and diners alike. He says that as we continue to see the growth of pay-later options in retail, we can likely expect other hospitality businesses to follow suit sooner rather than later.