To what extent do Aussies embrace automation in restaurants? We ask Domino's, The Cheesecake Shop, Muffin Break and Chatime

QSR Media talks to industry leaders heavily involved with store operations.

From robot kitchens in China to Uber Eats coming full circle with a dine-in option in the U.S., the global restaurant industry continues to witness how automation and artificial intelligence (AI) is reshaping restaurant operations.

Whilst Aussies have embraced or will embrace this brave new world, a quartet of restaurant executives tell QSR Media that these ongoing changes have to be accompanied by classic factors of old: personal human service and simplicity.

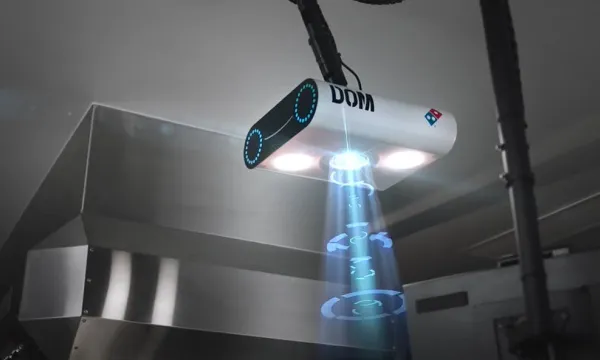

“Having a team member make food with the love, care and attention that only a human can provide is important to our business. Rather than automating the creation of food, we have focused our efforts on automating cumbersome internal processes like writing rosters and taking inventory,” Domino’s CEO for Australia and New Zealand Nick Knight explained.

“The Australian market isn’t too keen on gimmicks, rather they tend to praise smart, simple and thought-provoking ideas,” The Cheesecake Shop general manager for marketing & operations Peter Dable said.

“It’s absolutely amazing what is possible through the use of AI and automation and the Aussie consumer has embraced delivery apps to a huge extent,” Muffin Break national sales and operations manager Nina Cosgrove shared. “When it comes to your daily café purchase however, I truly believe the Aussie consumer still values exceptional personal service. It’s what makes you walk past three other cafés to get to the one that knows our name and your order, that asks about your day and genuinely looks forward to welcoming you back.”

Chatime operations head Arabella Richards notes a shift occurring over the last few years where customers, especially in the Gen-Y and Gen-Z categories, demanded a “know me, know my favourite” kind of personalisation, a concept that Australia’s top delivery companies have been doubling down on.

The chain recently launched a dashboard for franchisees that provides insights for their business, whilst testing a new procurement stock management driven by predictive analytics.

“Our first self-service kiosks go live this month in Sydney at Norwest and UTS (University of Technology Sydney) and we are currently exploring facial recognition ordering, being able to provide customers suggestions as they come up to the counter, demonstrating this personalisation,” she said.

“Future advancements will see our chat bots further help customers with their ordering process, again enhancing the experience. The next stage will be voice ordering, having the ability to do this through our apps.”

From left, clockwise: Domino's CEO for ANZ Nick Knight, Chatime operations head Arabella Richards, The Cheesecake Shop general manager for marketing & operations Peter Dable and Muffin Break national sales and operations manager Nina Cosgrove. Photo credit: Supplied

Greater opportunity in ‘third space/place’ transformations

The executives collectively agree that given the increase in online shopping and delivery options, the notion of restaurants being ‘third spaces’ - a term for a place other than home or work where community life takes place - is gaining ground, creating a need for restaurants and retailers to create extraordinary experiences.

Despite believing in delivery as the ‘ultimate convenience’, Knight noted that brands should not lose focus on the in-store experience.

“We’ve invested a significant amount of money and time in making our stores more attractive for pick-up and ‘eat in’ customers; without losing focus on our delivery vision. We want to be able to cater for all customers and meal occasions,” he said.

Dable is seeing the third space idea come to life through food courts and eating strips, which are becoming “far more communal”.

“Brands like Coco Cubano have done a fantastic job at making their spaces feel like a home away from home,” he said.

Cosgrove, meanwhile, stressed the greater footfall opportunity for brands who invest in various seating needs.

“To have a space to transition between work and home and be able to use this as a time to socialise with friends is a real drawcard. Smart operations are designing new venues with multiple functional areas to accommodate several different seating needs so allow for growth of the “third space” customer,” she said.

Richards said the ‘third space’ idea should prompt operators to “think harder” about location selection.

“With delivery options creating disruption to dine-in experiences, this is key to ensure you stand apart. This shift has been seen in shopping centres over the last few years where dining is now intertwined amongst retail outlets, and no longer just situated in the traditional food courts," she said. "Restaurants need to work out what is their point of difference in this ‘third space’ ensuring you are part of the critical mass.”

(Also read: The fundamentals of site selection, as told by Foodco, Sandwich Chefs, Bansal Group and Ogalo)

The executives offered a variety of trends they are keeping a close eye on. Knight says cashless payment, autonomous delivery and plant-based eating are on the rise, hence Domino’s ongoing trial of a ‘Tap & Take’ payment model, and recent announcement about their plant-based pizzas.

“We believe there will always be a need for delivery experts, but at some point in time the demand for food to be delivered as quickly as possible will surpass the number of people available to deliver it. When that day comes, we will be ready,” he said.

For Dable, operators need to examine the opportunities in snacking for lean periods.

“The rise of snacking options and street food is one to watch and it is ultimately going to change our eating habits away from the regular three meals a day. Snacking meets the need of the consumer. But from an operations perspective, [it] addresses issues of productivity and downtime during non-peak periods,” he said. “Labour and productivity efficiency is also becoming a hot topic and brands continue to look at ways to improve their franchisees contribution margin of COGs (cost of goods sold) and labour.”

Cosgrove lauded the ‘secret menu’ push, which she says is being embraced by fast food and even fine dining.

“Whether that means a chef expanding the menu one day to include something out of the ordinary featuring a prized ingredient or the items you can order from a chain only via their app – it all speaks to a desire to feel like we as the customer are a step ahead of others,” she said, adding that Muffin Break is also keeping a close eye on food waste and coffee ground collection to divert from landfill.

“There are many who are exploring options, although there isn’t quite an option that can be executed on a mass commercial level. We are excited for the opportunities that are starting to enter the market.”

Richards sees sustainability and local sourcing as a key trend, with their UTS location being their first to launch compostable packaging in August.

“We have seen consumers continuing to be health-conscious and as a brand this will play into our menu evolution and NPD (new product development),” she said, adding that ordering via phones in tables will also be something to watch. “Social media and engaging with customers will continue to evolve, and the key will be remaining ahead of these trends to engage your customers as the platforms shift.”

Choice-driven convenience

All four agree, however, that thinking about convenience is a must, with customers being able to choose being critical.

“Convenience is an enormous driver of customer satisfaction and we believe we offer the ultimate convenience through delivery. Ultimately, other restaurants will determine how they can best provide convenience to their customers, but for us, it’s all about opening kitchens closer to our customers,” Knight said.

“Brands aren’t typically reshaping convenience, rather they are simply keeping up with the aggregators that are creating demand and convenience. Our role is to deliver products that meet the needs of the changing consumer,” Dable added.

“For a restaurant to play in the convenience area, there are - of course - the musts like app ordering and delivery. However, when looking at operational changes, the idea of grab-and-go and pre-order for those wanting to still get that dine in experience is very important,” Cosgrove explained.

Richards adds: “We have also seen a shift with pre-ordering...this convenience option is becoming more and more popular.”