Emerging QSR brands crush major chains in December customer satisfaction rankings

Fonto data reveals a major shakeup in Australian fast food.

New and emerging quick-service restaurant (QSR) brands in Australia are gaining traction with consumers, as those able to deliver strong customer experiences are being recognised in rankings.

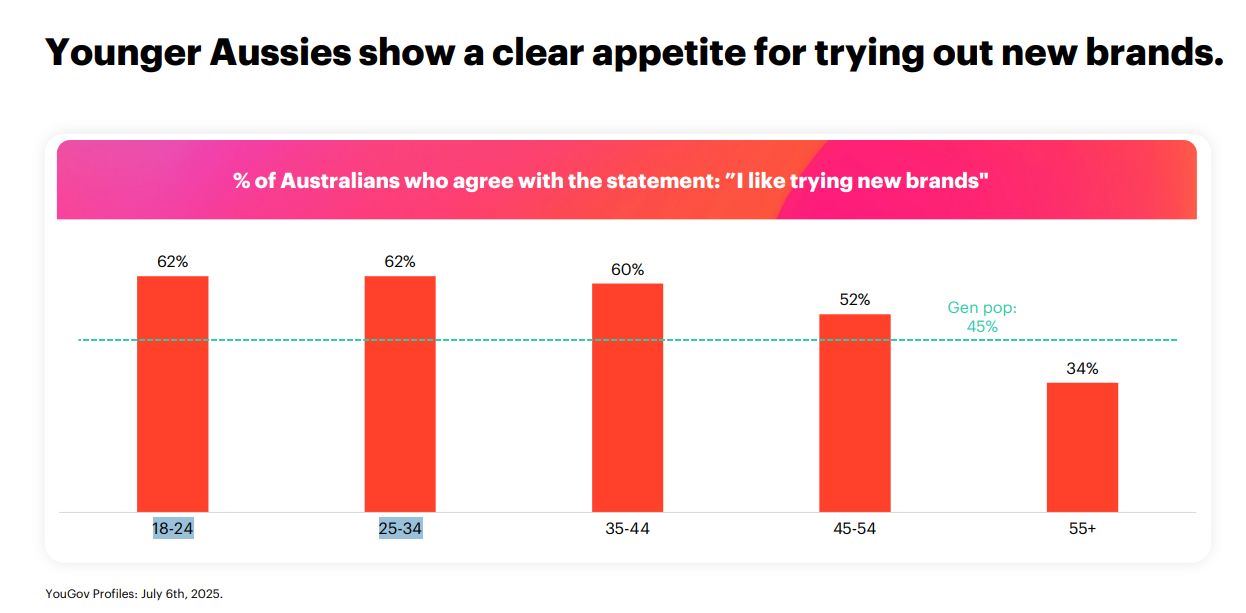

In a report published in September 2025 by YouGov, one in two Australians said they like trying new brands. This trend is reflected in Fonto’s QSR customer satisfaction rankings for the December quarter 2025, where Soul Origin and El Jannah joined the list.

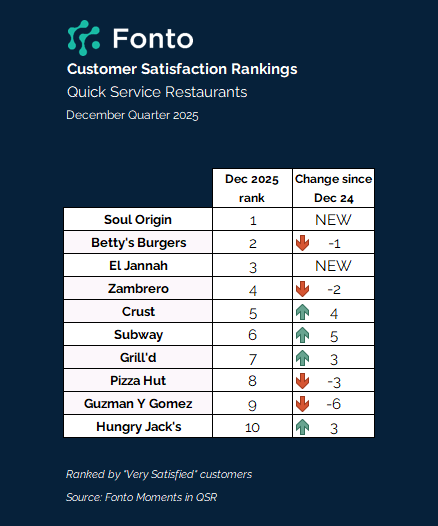

Soul Origin moved into first place on the overall customer satisfaction rankings, ahead of Betty’s Burgers, El Jannah, and Crust Pizza.

Fonto triggers customer satisfaction surveys from purchases made with all major QSR brands and tracks comparative satisfaction and other customer experience variables. Rankings are based on “overall satisfaction” and driven by the percentage of customers who indicated they were “very satisfied” (top box).

Several major brands saw notable changes during the quarter. Subway rose six places to finish fifth, Crust climbed four places into the top five, and both Grill’d and Hungry Jack’s jumped three places each to reach the top 10.

Soul Origin, tracked by Fonto since mid-2025, has gained prominence as it expands beyond shopping centre locations. During the December quarter, the brand opened its first drive-through store in Epping, Victoria. Meanwhile, Hungry Jack’s performed strongly despite its large scale, moving into 10th place on the rankings.

“Hungry Jack’s has put a lot of effort into keeping their menu fresh, and our data shows it has been winning when it comes to customer loyalty. We are seeing a definite increase in the frequency of purchase, particularly amongst younger generations,” said Ben Dixon, CEO of Fonto.

Not all brands saw gains. Guzman y Gomez, which has continued rapid topline growth despite weak share market performance, dropped from third to ninth place. The decline reflects operational challenges of rapid expansion and rising customer expectations as it becomes a mainstream QSR brand, Fonto said.

The report also highlighted cult-favourite brand Yo-Chi, which saw its market penetration among Australians aged 18 and older increase by 5% during the December quarter, an estimated 1.4 million new customers. “Although not a natural competitor to the large-format hot food chains in QSR, Yo-Chi is highly regarded amongst the QSR community for its low operating costs and ease of operational implementation,” the report said.

YouGov’s September 2025 report supports this data, showing that younger Australians show a clear appetite for trying new brands.