Cash registers ring for retail property market

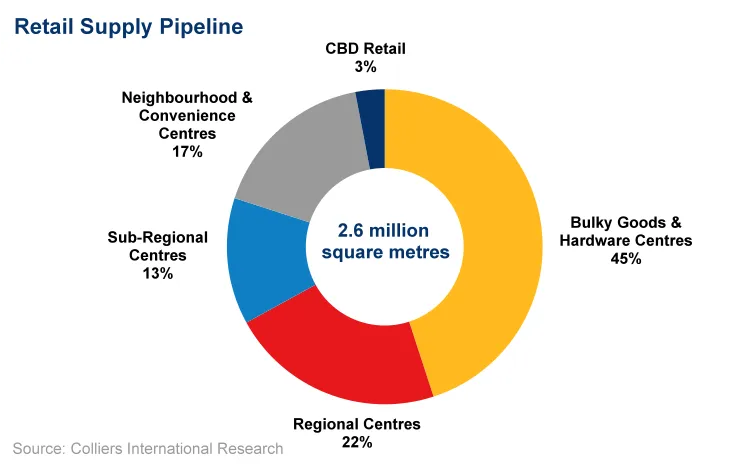

2.6m sq.m. of retail space are under construction.

According to a recent research report from Colliers International, the future of retail property is presenting a positive outlook. Recent increase in capital expenditure and investment reflect investors’ confidence in the long-term outlook of the sector.

Colliers International’s Head of Retail, Michael Bate, reported that the country’s CBD centres remain to be a popular destination for shopping, with the help of the arrival of international brands such as Holister, Samsung, Apple, Zara, Topshop, and Williams Sonoma.

Along with this, on-going refurbishment and expansion of various CBD retail locations also helped boost the development of the retail sector, which attracted local and international retailers and increased pedestrian traffic.

“Our research has identified around 2.6 million square metres of retail space currently under construction or expected to complete over the next five years.

“Across the major listed retail property owners, the retail development pipeline is in excess of $10 billion, indicating that refurbishment and expansion are key to attracting new tenants and continuing to drive demand, as we have seen in many CBD retail projects of late,” said Nora Farren, Director of Research at Colliers International.

Read the full research report from Colliers International here.

Below is a Q&A with Warwick Turpin, Director NSW Retail Leasing.

QSR Media: You mention negotiations with landlords are now in the tenants favour, what would your advice be to a QSR ?

Turpin: Make sure you’re competitive and pick your location carefully. The competition for QSR businesses in the CBD areas is still strong – food continues to have an enduring appeal. While the market is softer in the suburbs, if you choose a growth area you are likely to have a strong long-term business.

When negotiating on your chosen location, don’t be cheeky with your offer. Quality sites are still attracting strong competition, so as long as your offer is sensible and competitive you should be in a good position.

QSR Media: What do you consider the top 3 "take home" points from this report for QSRs?

Turpin: 1. Look at sub regionals as a good long term location. These centres are repositioning themselves and are proving they can do so quite quickly. Hence they’re becoming an attractive alternative for QSRs, especially in growth corridors such as the western suburbs of Sydney.

2. Get back to basics, get your position right, do your research and you will have a far greater chance of success.

3. Professional and sensible proposals to landlords won’t be ignored. It’s a great time to open a new business as there are some attractive sites out there that have great prospects, so make the most of the opportunities that are currently available.

QSR Media: Any other comments?

Turpin: Given the investment in bricks and mortar retailing we believe the outlook for this sector is strong. There are opportunities abound for QSRs, and as always it’s about getting the basics right.