Domino's exhibits strong growth according to J.P. Morgan

Armina Soemino, Equities Research of J.P. Morgan has noted that Domino's exhibits strong growth prospects and margin expansion with its store roll out plans.

Domino's recently reported a half year Net Profit after Tax of $29.1 million, up 44.2% on the prior corresponding period (pcp) last year. It attributed its strongest profit for a half-year period to digital and product innovation, record store count growth, overseas earnings from Japan, economies of scale and crowdsourcing initiatives. The pizza chain delivered a solid result, according to Soemino, noting strong results across all regions.

AT HOME

She highlighted that Australia and New Zealand same store sales (SSS) was very strong 10.6% vs 5.6% in the pcp. In addition, "revenue increased 5% to A$102.2m with EBITDA margins improving dramatically by 5.3ppts to 34.3%. Order counts from online and mobile sales have grown 22% on the pcp. EBITDA improved despite the fact that the company had to materially increase its contribution to the National Adfund to support the launch of Pizza Mogul and the A$4.95 Cheaper Everyday campaign, indicating a good ROI from these initiatives."

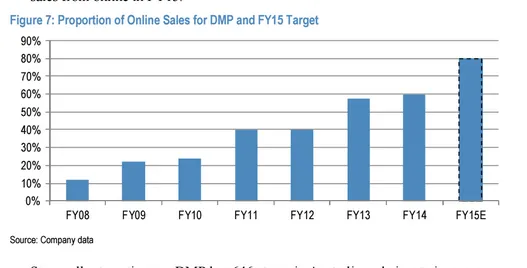

"Management believes that the biggest driver of the ANZ business today is technology innovation rather than product innovation. It aims to have 80% of sales from online in FY15," she shared. " The company expects to announce a big new initiative to go after other QSR segments, including the chicken and cheeseburger markets, over the next 3-4 months which is slated to be “one of the biggest operational changes” the company has ever had."

Domino's will also be rolling out its GPS tracker 2H15, allowing customers to track pizzas to their door. Soemino noted that it has already been introduced into 38 stores which has halved the number of driver incidents and improved productivity by 20% per driver.

GROWTH IN JAPAN AND EUROPE

In its presentation, Domino's report strong profit growth in Japan attributing it to store count growth, along with excellent food and labour control in corporate stores.

Soemino noted that the chain continues to win share in the market and opened a record 34 new stores in 1H15, adding, "we expect strong growth in profitability driven by store rollout, a mix shift towards franchise and carryout and implementation of the global POS and online ordering system."

She believes that strong growth will continue in Japan, supported by:

- Increased store rollout

- Continued relocation into high-street locations.

- The continuation of Domino's internal franchisee financing program for high performing store managers.

- Upgrading Japan stores to the DMP “Entice” format

- Shifting the store mix from 20% franchise currently to 40% over the next five years.

- Increasing the proportion of carry out sales

- Economies of scale (marketing costs are extraordinarily high in Japan but should decrease per store as add more stores.)

- Conversion of both the existing point of sale system to the global POS (Pulse) system and online ordering platforms to be completed by the end of CY15.

Along with Japan, Soemino also shares a strong turnaround of Europe. "Since the relocation of Andrew Rennie back to Europe 12 months ago, the region has posted a significant turnaround and is now expecting to deliver “double-digit” EBITDA margins in FY15. Margins will further benefit from the opening of the commissary in early 2016 and the completion of the rollout of the Pulse POS and online ordering systems."