Everything you need to know to apply for a humm®pro digital card

Here’s a step-by-step guide to help QSRs gain access to up to $30,000.

Buy Now, Pay Later (BNPL) has proven to be an empowering payment option for retail customers as it enables them to make purchases and split them into smaller deferred repayments. hummpro aims to bring the same flexibility and convenience of this payment option to small and medium businesses, thereby allowing them to be more in control of their cash flow even amidst the global pandemic.

“Cashflow may sound like a simple concept — ensure you have more money coming in at any given time than going out — but it’s one of the most challenging issues small businesses face,” says Alan Yeo, Head of Innovation Delivery at hummgroup. “On the revenue side, it may be hard to predict sales, or there may be unexpected events like the pandemic and lockdowns that impact your sales. Or you may have trouble chasing payments from your customers. Meanwhile, on the expense side, business overheads like wages and rent keep adding up. You might have unplanned for expenses like urgent repairs. All this before you even consider the cashflow you need to grow your business. Cashflow concerns keep many business owners awake at night,” adds Yeo.

Businesses like those in the QSR industry can get a pre-approved, interest-free credit line of up to $30,000 to have always at the ready, without having to provide security or a personal guarantee, and without having to go through a lengthy process to apply.

Convenient application process

hummpro is an app-based facility so QSRs can apply in just a few minutes using a mobile phone. Here’s a step-by-step guide:

Step 1: Download the app

Go to the App Store or Google Playstore and download the hummpro app.

Step 2: Create an account

Using the App, the applicant — who must be an authorised person for the business (e.g. a sole trader, director, partner or trustee)— will be asked to provide an email address and mobile number which will serve as their login credentials.

Step 3: Set your credit limit

The next step is to choose a credit limit, which can be as high as $30,000.

Step 4: Provide applicant’s personal information

One ID will be required, which could be an Australian driver license or Australian passport.

Step 5: Provide business information

The App will then ask for the Australian business number (ABN).

The business will be asked to provide a bank statement by linking its bank account to the App.

Step 6: Get approved!

The application will be instantly decisioned. In instances where hummpro needs to further review the application, waiting time won’t take weeks or months; the turnaround time is just one business day.

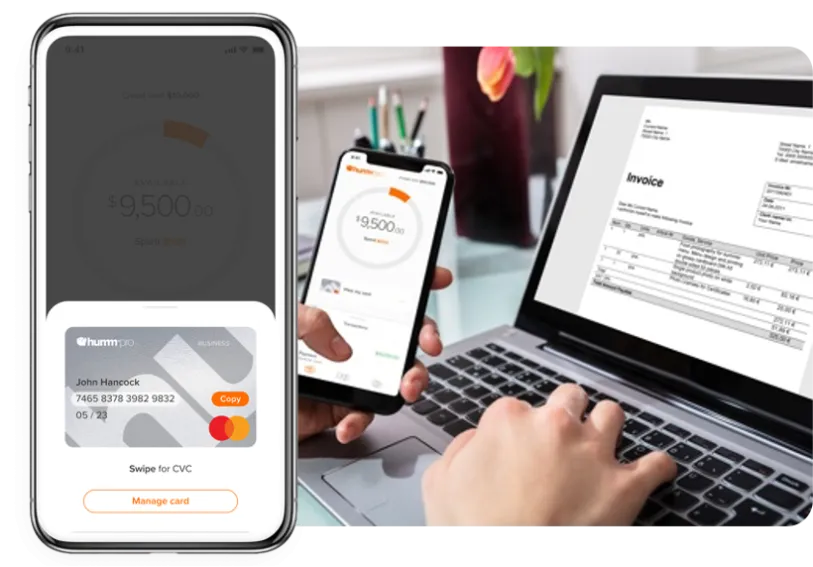

When the application is approved, the hummpro digital card is activated automatically and can be used immediately, whether online or over the phone for business purchases. For in-store or in-person transactions, the user can access the card in their Apple or Google wallet.

“You can use hummpro everywhere Mastercard is accepted, both online and in-store. And it’s not just for your bigger business buys. hummpro can also be used even when you're taking a client or supplier out to lunch,” Yeo explains.

Flexible repayment options

Providing flexible cash flow management is at the core of hummpro’s solution. At the end of each month, all your purchases are grouped into a single balance which you get a full month before its due. hummpro also offers flexible repayment options where customers can either “pause” or “plan” their repayments.

“Business owners can conveniently choose to pause repayments and get an extra month of breathing room for a fee of just 3.5% of their paused balance. This can be done up to two times on each monthly balance, so businesses can take a break from obligations on months where cashflow is tight,” Yeo adds.

hummpro users can also convert any monthly balance to a 6, 9, or 12-month plan for a fee of just 1.5% per month, payable only whilst the plan is open. If cashflow allows, the Plan can be paid off early to save on plan fees.

Pauses and Plans can be initiated easily through the App.

Customers also get fresh repayment terms for each new monthly balance which they can choose to Pay, Pause, or Plan, without affecting previous month’s repayment arrangements.

“With all these offerings, we stay true to our commitment of ‘business now, pay later’. Our solutions are designed to help empower businesses to be in control of their cash flow, especially on circumstances that challenge the sector, like the current pandemic,” says Yeo.