Will plant-based and ethnic cuisines reshape the Australian fast food scene?

Belles Hot Chicken, Lord of the Fries, and Caltex Australia weigh in on the growing meat-free trend.

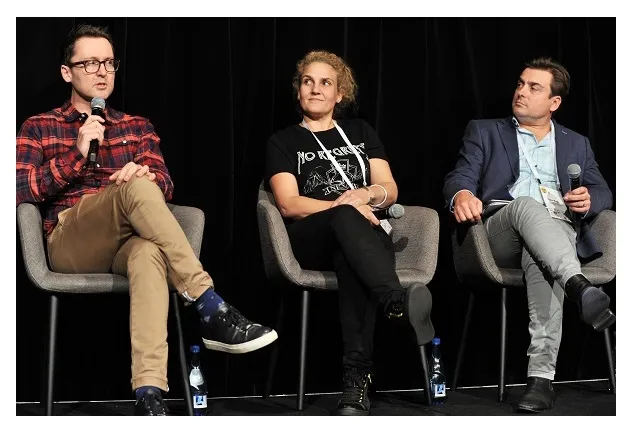

Plant-based and ethnic cuisines are some of the food trends that are quickly growing in the country’s fast food scene, according to a panel of executives from Belles Hot Chicken, Lord of the Fries and Caltex Australia, which handles the Nashi and The Foodary concepts.

“Plant-based food is a growing market,” Lord of the Fries co-founder Amanda Walker said during a panel discussion at the 2018 QSR Media Detpak Conference and Awards. “We are going to see a lot more mock meat; there are mock meat steaks and all kinds of innovations in the plant-based world. That's really exciting.”

Lord of the Fries is known for serving entirely vegetarian and vegan meals, and made headlines around the QSR space for being the first Australian chain to serve the Beyond Meat burger – a meat-free offering that features a patty made from plant-based protein. Walker, however, noted that they do not actively promote themselves as vegan.

“We sort of keep it on the down low. We feel that it's quite controversial and divisive to try to polarise people who are vegan and not vegan. We just focus on the quick service, great food, and innovative products,” she said.

“I'm absolutely obsessed with plant-based eating at the moment. All logical people think that this has got to be a big trend in the future,” added Dehne Bingham, who is the CEO of 100 Burgers Group that owns Belles Hot Chicken and Mr Burger.

He cites the growing concern for the environment, the ethics around animals, and the health component as factors in the rise of plant-based options. He then lauded Lord of the Fries for their way of marketing their vegan options.

“They've got the good sense to go ‘This isn't an argument over ethics; it's not about vegans versus everyone else. It's actually just about good food that happens to be meat-free.’ And I think that's exactly the right approach.”

“It's a market that you don't want to isolate. But what I found personally is that people actually target specific vegan-related stores as a whole. Whereas in a mixed dietary environment with meats and non-meats, I feel that the national market is not as big as it could be or should be,” Sam Nash, Caltex Australia’s Head of Retail for High St., observes.

Aside from identified vegan and vegetarian options, Bingham also noticed that brands that feature naturally meat-free Middle Eastern cuisine are growing quickly in the food and beverage space.

“There's no stock market for this. But if there were shares in Middle Eastern food, I'd be buying now like I would've bought Mexican [food] five years ago. It's kind of the next big thing,” he said, naming a couple of Middle Eastern brands that he said are growing “really quickly.”

Bingham also stressed that the meat-free trend is far being a mere fad.

“I think that meat-free is absolutely a trend and not a fad. But… there's a few chains on this very ‘functional’ eating thing and I think just like Crossfit and F45 it feels like a bit 'Here today, gone tomorrow.' That functional [way of eating] doesn't connect emotionally with people.”

Bringing authenticity to a trend

Asked about means to identify trends, the panel cited social media, television and the overseas food safaris as some of the means to do so.

“We do a lot of research online and see what's happening around the world. We follow polls of what's going on at our favourite restaurants, even if they're not vegan we sort of look and see what's moving around and then we convert it into something that works for us as a brand and that we would be personally excited to eat,” Walker said.

“It’s really just looking out at your competitors, seeing what's going on in that space, as well as on the food shows that are going on in television at the moment as well,” Nash added.

“One of the most overused words is ‘authenticity’, but if you can't actually bring a bit of yourself to that food trend, what's the point,” Bingham remarks. “It's more about how do we place the right idea that fits with our business kind of in our menu so that we don't look like we're just jumping on the latest thing, which I think is the bigger danger.”

Determining the success of a new product

The panel also offered their insights on determining the levels of success in introducing new products.

“Sometimes, you have a product that only appeals to a small part of the market but if you still able to sell the volume that you're making to that market you know then that's okay. It really depends if it's a viable product you're making from a cost perspective and to the demand of how it's selling so it changes,” Nash said.

“You got to define your purpose. Is it a big strategic play or is it a bit of fun for the customer just to bring a few more people through the door? If it is a big strategic play, I'd hang with it for longer,” Bingham added.