Fast Casual in International Markets: Where’s the Opportunity?

Analyst Insight by Elizabeth Friend - Senior Consumer Foodservice Analyst at Euromonitor.

There’s no question that fast casual has become the centre of foodservice growth in the US, but it has become an international phenomenon as well, albeit one that has taken a much different form. Euromonitor International’s 2015 global fast casual data, launched May 19th, paints a very different picture of domestic and international growth. Rather than manifesting via explosive growth through a few seemingly unstoppable chains, international fast casual has come as a result of a slow and steady evolution in consumer preferences. Just like American consumers, young people in wealthier cities all over the world are shifting toward more modern, more casual dining experiences, opening up opportunities for plenty of global fast casual growth over the long-term.

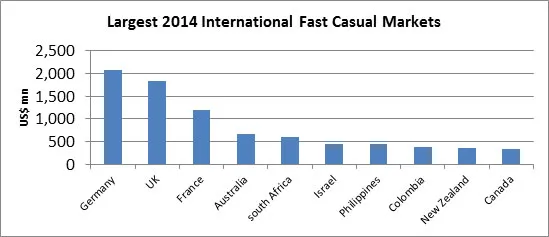

So far, fast casual segments in most developed markets have experienced an entirely different growth trajectory than in the US. The largest international fast casual markets are so far developing in Western Europe, with Germany, the UK and France topping the list with between US$1-2 billion each in 2014. However, each of the three has seen the segment growing slowly but steadily over the past five years at an average annual rate of between 2-8%. On its face this might seem to indicate that fast casual hasn’t been quite as successful in Western Europe, but that doesn’t tell the whole story. In all three of these markets, fast casual has grown to a percentage share of the total fast food market that ranges from 7 in the UK to 14% in Germany, well within the range of the US’s 10% fast casual share.

So what exactly does this mean to fast casual prospects? Is there an opportunity for fast casual growth in international markets, and for which operators? Below, we’ll take a look at what’s going on with international fast casual, where the growth is currently, and how best fast casual operators can take advantage.

The largest markets are in Western Europe

A look at the largest markets clearly favours Western Europe, where there are high disposable incomes, highly developed dining cultures, and a preference for premium restaurant experience. These characteristics may seem primed for fast casual growth, but the slower rates seen in the region can be traced back to differences in the historical competitive landscape. The initial boom in fast casual in the US occurred during the recession, when consumers were eager for more value-focused dining options that didn’t sacrifice on flavour and experience. There was an enormous chasm between full-service, with low prices, slower service, and higher quality, and traditional fast food, with fast service, rock-bottom prices, and utilitarian dining rooms. Fast casual slid easily into the white space in between, discovering billions in untapped demand and kickstarting the current fast-casual movement.

In Western Europe however, the landscape is far less divided. Traditional fast food operators like McDonald’s and Burger King have known for decades that more premium fast food offerings would be a better fit for Europeans, and as a result, many local fast food outlets already more closely mimic the experience of a fast casual. This has meant that the gap between fast food and full-service simply isn’t as large, leaving less room for fast casual to move in and gain share.

That said, fast casual is still gaining traction for slightly different reasons. In addition to the emphasis on high-quality ingredients, fresh preparation methods and more comfortable outlets, fast casual offers a flexibility that is not typically offered in full-service and has high appeal for Western Europeans. Fast casual offers local consumers the high-quality experience they want in a restaurant meal, without any of the hassle of full-service.

The next frontier in fast casual? The Middle East and everywhere

A look at the fastest growing fast casual markets gives a better view of where fast casual might be going in the future—which is, in simple terms, everywhere. This trend is something that’s now developing not necessarily at the market level, but at the city level, where higher-income, urban consumers all over the world are developing a similar taste for more modern, more flexible dining experiences. There is likely never going to be another market that mimics the success of US fast casual on such an enormous scale, but there are now smaller, much more targeted but nonetheless lucrative, opportunities for fast casual concepts all over the world.

The Middle East in particular has emerged as a major fast casual target, with many US concepts now looking directly to the UAE or Saudi Arabia before they’ve even begun developing within their home regions. Dubai is an extremely attractive growth target due to its high demand for premium, branded experiences and its well-developed mall culture that offers international chains easy access to high-profile—and heavily trafficked—locations. Illustrating this trend, many successful US fast casual concepts have begun looking to Dubai for international growth well before nearing saturation in their home states. 20-outlet fast casual cafeteria chain Lemonade is already working on its second UAE location, while better burger chain Shake Shack has been franchising locations in the UAE since 2012, and has also opened in other major cities like London and Moscow.

This strategy, more than anything, points the way forward in international fast casual growth. This trend isn’t necessarily something that’s unfolding at the market level, but rather wherever consumers are young, reasonably wealthy, sophisticated and eager for new dining experiences. The long-term opportunity in fast casual lies in the fact that consumers all over the world are changing their habits and shifting toward more flexible, more casual, and more ingredients-focused dining experiences. That has moved far past fad to megatrend, and it’s not expected to slow down any time soon.